Clear Partner Reporting Done Right

Schedule Business Partnership Tax Preparation in Forest Grove

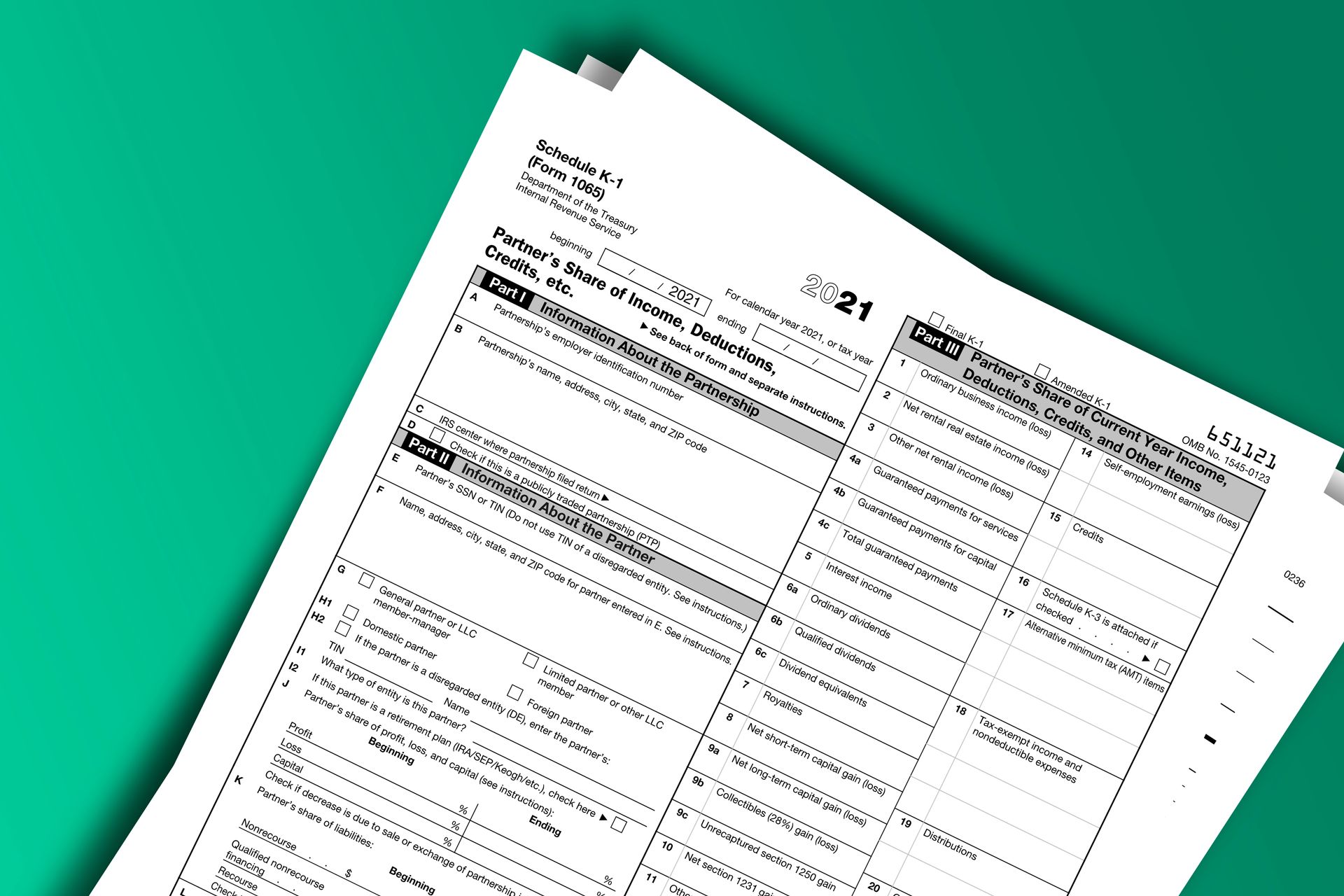

You manage a partnership with multiple people sharing responsibility, and tax season brings the added complexity of tracking income, losses, and distributions across partners. Whether your operation is a family business, contractor team, farm, or service group, Forest Grove partnerships need accurate K-1 forms and clear reporting to stay compliant. TLC Bookkeeping And Tax Prep Inc. prepares partnership returns with detailed breakdowns that every partner can understand, using careful review processes designed for multi-partner businesses.

Your partnership relies on timely K-1 forms so each partner can file personal returns without delay. This service ensures every form is accurate, delivered on schedule, and prepared to withstand IRS scrutiny. Early coordination among partners prevents filing delays and keeps your business records clean throughout the year.

Arrange your business partnership tax preparation in Forest Grove and keep your multi-partner operation running smoothly.

What to Expect When You Book

You start by gathering partnership records including income statements, expense receipts, and documentation of any capital contributions or distributions made during the year. This preparation work in Forest Grove ensures your return reflects every detail accurately and reduces the chance of partner disputes or IRS questions down the line.

TLC Bookkeeping And Tax Prep Inc. reviews each partner's share of income, losses, and deductions to prepare K-1 forms that align with your operating agreement. Careful review processes catch errors before filing. Each partner receives clear documentation that simplifies their individual tax preparation.

Your return is prepared using industry-standard software and submitted with complete supporting schedules. You receive copies of all filed forms, and your partnership stays positioned to avoid penalties or audit risks. Early coordination among all partners ensures the process moves forward without unnecessary delays.

Partnership tax preparation raises specific questions about timing, accuracy, and partner responsibilities, especially when your business involves multiple income streams or complex distributions common in Forest Grove operations.

Key Benefits of This Service

Your partnership benefits from accurate reporting, timely K-1 delivery, and clean records that reduce IRS risks. When every partner receives clear documentation and understands their tax responsibilities, your business stays compliant and avoids costly errors. Reach out today to secure professional partnership tax preparation for your Forest Grove operation.